About

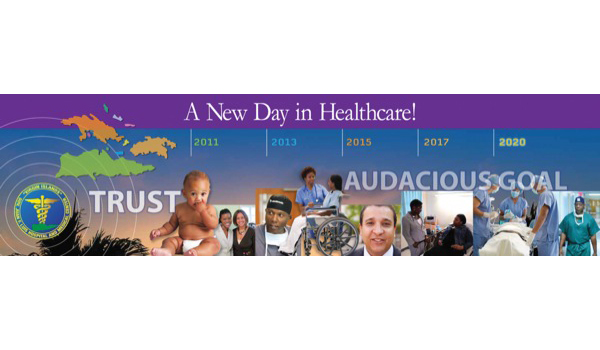

SMC is a full service graphic design studio specializing in working directly with our clients to think strategically that will drive all of their creative. This will make their brand meet their objectives and generate long-term value.

CORPORATE IDENTITY

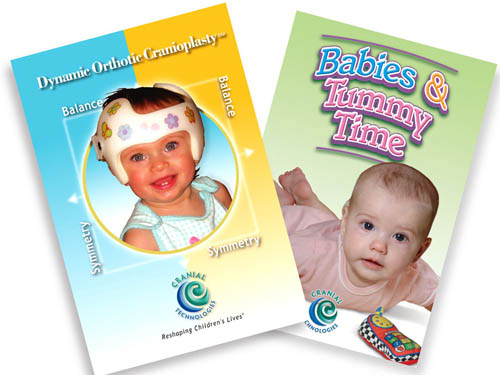

BROCHURES

PACKAGING

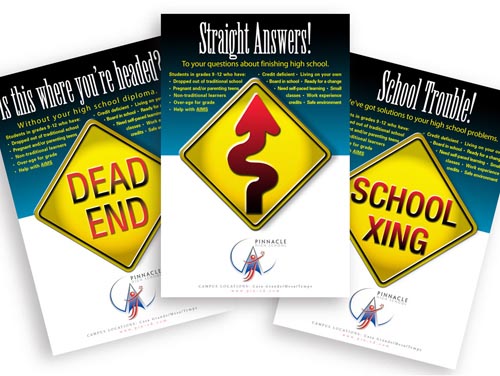

ADVERTSING

WEBSITE

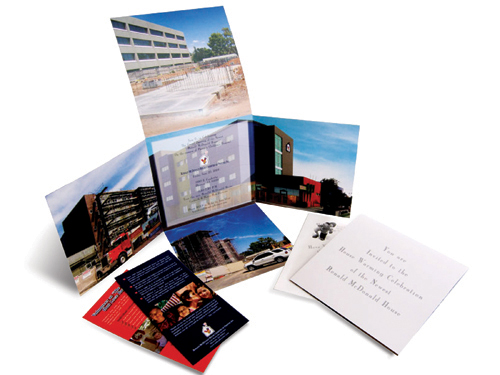

DIRECT MAIL

GRAPHIC DESIGN

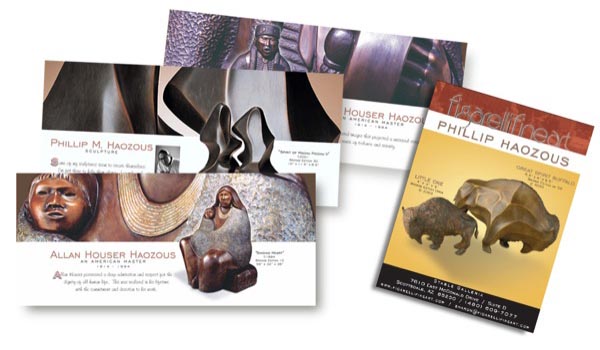

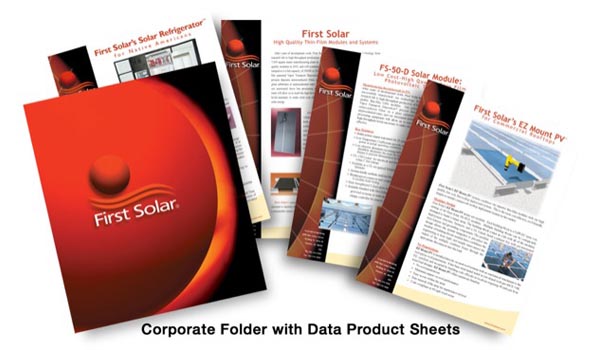

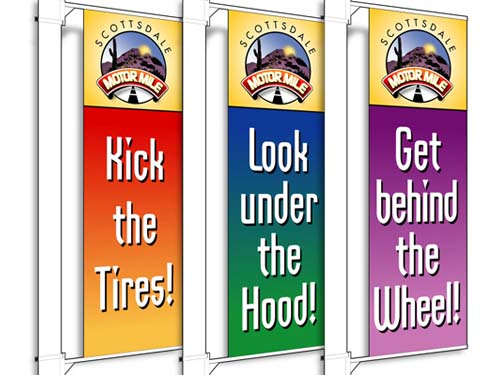

COLLATERAL MATERIALS

CORPORATE COMMUNICATIONS

BROCHURES

PACKAGING

ADVERTSING

WEBSITE

DIRECT MAIL

GRAPHIC DESIGN

COLLATERAL MATERIALS

CORPORATE COMMUNICATIONS

- Copyright © 2026 Sullivan Marketing & Communications